America!

the past 12 hours in a Continuing Education class discussing the changes that

are required for Dodd-Frank/CFPB regulations.

And let me tell you it’s a massive, madness, unbelievable, un-holey nightmare. We are going to have to hire a full time

person just filling out forms so the government can track you even

more.

BUT

maybe we won’t.

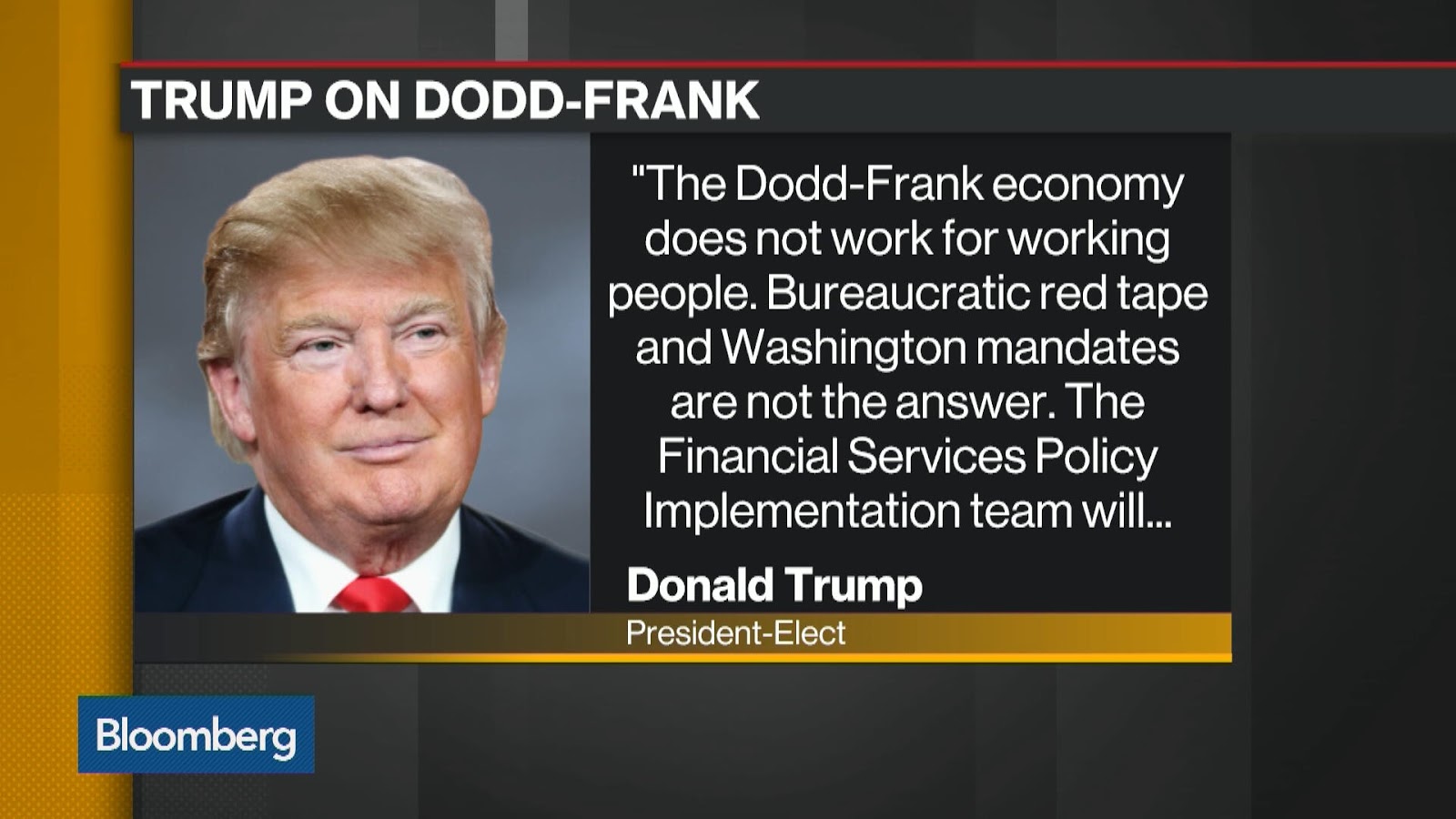

circulating in Washington that a top priority within Team Trump going forward is the swift and decisive dismantling of the disastrous and highly

controversial Dodd-Frank Wall Street reform

legislation that has resulted in record-breaking bank profits while decimating

the small-business and private party loan environment that is doing yet further

harm to an already weakened American Middle Class.

Democrat-sponsored bill greatly favored the richest of the rich who could

afford to wade through the monstrous layers of red tape, while crippling smaller banks and businesses

who could not do so. The result was further consolidation of the banking

industry, less competition, and ultimately, fewer choices to the

consumer. Personally, I’m amazed that any small mortgage company is even still

in business or making any money.

January 20th, the new president expects Congress and the White House to move quickly to

dismantle the Dodd-Frank boondoggle and bury it deep within the growing

trash-bin that was once the Obama legacy.

in terms for a Realtor, if the Dodd-Frank rules were applied to a Realtor this

is what it would be like in general terms.

not get signatures and disclosures to your buyer or seller in a timely

manner. – YOUR FINED

typo on your contracts sales/listing – YOUR FINED

to seller for buyer/broker fees cannot ever exceed 3%. That 1.5/1.5 for the split.

seller/buyer feels that they were treaded un-fairly you will have to give them back

your commission and then – YOUR FINED.

buyer/seller complain to the CFPB you may be audited and will have to pay for

the cost of the audit.

have to collect data on the national origin, sex, status, results, sales,

status, time, discussion, and much more on everyone who you talk to

about selling/listing a home. Up to 138

different items to collect on everyone. Even if you don’t list or sell

them a home.

prayers.

at the Dodd-Frank measures, its frustrating that this piece of regulation ever

came to being. It’s equally frustrating

that there is no way that I can change the rules and fix the situation. However, I do have an ace in my back pocket

that can fix anything and lately this ace is fixing a-lot-of-things in the

world. All you have to do is ask. Miracles and answers to prayers do happen and

this is all we can do to fight the stupid corrupt people in charge.

Cubs win!

Cuba is going to become free!

Wins!

be….

that God answers payers. So keep praying, because this all we can do. This massive,

unbelievable, un-holey nightmare will end.

Broker/RI/CEO/MLO

Level 4 Funding LLC

Tel: (623) 582-4444 | Fax: (888) 279-6917

www.Level4Funding.com

NMLS 1057378 | AZMB 0923961 | MLO 1057378

22601 N 19th Ave Suite 112

Phoenix AZ 85027

industry in some capacity for the last 40 years. He purchased his first

property when he was just 18 years old. He quickly learned about the amazing

investment opportunities provided by trust deed investing and hard money loans.

His desire to help others make money in real estate investing led him to

specialize in alternative funding for real estate investors who may have

trouble getting a traditional bank loan. Dennis is passionate about alternative

funding sources and sharing his knowledge with others to help make their dreams

come true.

Arizona resident for the past 40 years. They have 2 beautiful daughters 5

amazing grandchildren.

![Level-4-Funding-Dennis-Dahlberg-Mort[1] Level-4-Funding-Dennis-Dahlberg-Mort[1]](https://lh3.googleusercontent.com/-aF-ke_K6CG4/V4Z0vHp_19I/AAAAAAAAJ30/J3B2tNpVP3o/Level-4-Funding-Dennis-Dahlberg-Mort.jpg?imgmax=800) Dennis Dahlberg

Dennis Dahlberg