money they’ve in the financial institution, or via a mortgage loan borrowed from a financial institution.

Realistically, there are various paths to dwelling possession, and the best is usually

via hard money lenders in Texas.

All people wants a spot to dwell, however the conventional system

makes it not possible to purchase a house, and even lease one, when there’s a blip in

your historical past. Sadly, that is the very actual scenario many People

face. The financial recession damage virtually everybody’s credit score, and has left so

many households with out housing choices, even years after the disaster.

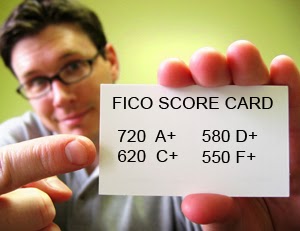

take a look at all types of issues, together with your credit score rating, earlier

bankruptcies, and employment historical past. When you don’t make the reduce, or they assume

you’re an excessive amount of of a threat, they refuse to supply a mortgage. Banks will even

deny you in case your credit score is ok, however you occur to be making use of on the similar time

as others with increased scores.

particular deal with social and financial insurance policies. The group has been actively

researching because the 1960s, and in 2013 they launched an enormous bombshell. Banks

have traditionally claimed that they solely deny about 14% of purposes, however

the City Institute leveled the taking part in discipline by eliminating these with excellent

or near-perfect credit score from the calculations. In doing so, they found that

the speed of denials is triple the quantity banks declare for these with lower than excellent credit score. Contemplating

that solely zero.5% of us might ever obtain an ideal score, most of us fall right into a bracket with a

43% denial price, which is why hard money

lenders in Texas are extremely widespread.

Hard Money Lenders in Texas Give that 43% a Profitable Path to

Residence Possession

Banks have many guidelines and restrictions on who they’ll lend

to, however if you borrow from hard moneylenders in Texas, the money and the choice are handed down by one individual,

or a small group of individuals. This technique of lending isn’t restricted by the identical

tips and insurance policies, as a result of the money that goes to fund the acquisition of

the house comes from sources like private funds and retirement accounts.

As an alternative of specializing in a person’s historical past, the choice on the quantity of

money wanted and the worth of the property or belongings.

Relying on eligibility, 100% of the price of your own home might be funded via

hard money lenders in Texas.

cost, hard money lenders in Texas

could possibly provide you with a loan for the total buy worth of the property you

need. Which means it’s a lot simpler to purchase a house, and it’s considerably

simpler than making an attempt to qualify with a financial institution. It’s value noting that the individuals

who loan the funds are buyers, and so they need you to succeed, however they’re

additionally loaning out their private funds, which implies that it could price a bit

extra. Because of this, many individuals make the most of this feature to buy a house

initially, after which safe a standard mortgage after they can qualify for one

at a later date. The extra step is usually of little concern to

dwelling consumers, as a result of it allows them to have the keys to their very own residence

lengthy earlier than it might occur by different means.

Dennis Dahlberg

Dealer/RI/CEO/MLO

Arizona Tel: (623) 582-4444

Texas Tel: (512) 516-1177

dennis@level4funding.com