In case you are an actual property investor, you want hard money loans Texas monetary specialists use themselves. Hard money loans are a little bit know however very efficient financing technique that may assist you put money into actual property and make your desires come true.

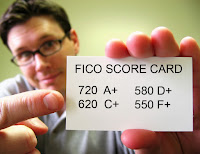

There’s a effectively stored secret within the funding world, hard money loans Texas monetary specialists agree are possibility for a lot of actual property buyers. A hard money loan is an asset primarily based loan that makes use of actual property that’s supposed for buy as collateral for the loan. The money loaned relies on quite a lot of elements together with the benefit of the funding, potential to earn money, and the worth of the property you might be shopping for. Different elements like credit score rating or private funds do not normally determine into the lender’s resolution to present out hard money loans Texas buyers depend on to finance their actual property purchases.

Whereas there are lots of, many advantages to hard money loans, Texas buyers have usually by no means heard of them. Hard money loans might be a good way to get financing in the event you want quick money, or have some blips in your credit score historical past. Approval time is quick and you’ll be able to normally get your money the identical day. This makes them an buyers dream come true as a result of you should use them to buy public sale properties and different properties which will require a fast resolution or a money solely sale.

Upon getting determined hard money loan is the best choice for you, listed below are three issues that you must know before you purchase.

1. Hard money loans have the next rate of interest. Since approval instances are so quick and the impression of your credit score rating is so low, hard money loans are the next danger for the lender which suggests you pay the next rate of interest. Nonetheless, you will need to remember the fact that hard money loans needs to be brief time period loans, which suggests the quantity of curiosity you pay is negligible, even when the speed is larger.

2. Ensure you have a plan. Whereas hard money loans are straightforward to get, they aren’t given out to anybody who walks by way of the door. Come to your lender with a property in thoughts and plan to make money, This can assist be sure that you get your loan rapidly and with none trouble.

three. All the time have an exit technique. This goes together with having a plan. Ensure you crunch your numbers to determine precisely what that you must promote a property for to interrupt even and to make a revenue. Put together for the worst case situation so you do not find yourself dropping all of it.

Upon getting determined that you simply want a hard money loan, name our specialists at Stage four Funding. We focus on various financing strategies for actual property buyers and may also help you select the appropriate loan product to suit your wants.

Stage four Funding LLC

Arizona Tel: (623) 582-4444

Texas Tel: (512) 516-1177

dennis@level4funding.com

www.Level4Funding.com

NMLS 1057378 | AZMB 0923961 | MLO 1057378

23335 N 18th Drive Suite 120 | Phoenix | AZ | 85027

111 Congress Ave |Austin | Texas | 78701

Concerning the creator: Dennis has been working in the actual property business in some capability for the final 40 years. He bought his first property when he was simply 18 years previous. He rapidly realized concerning the superb funding alternatives supplied by trust deed investing and hard money loans. His need to assist others make money in actual property investing led him to focus on various funding for actual property buyers who might have bother getting a standard financial institution loan. Dennis is keen about various funding sources and sharing his information with others to assist make their desires come true.

Dennis has been married to his fantastic spouse for 38 years. They’ve 2 stunning daughters four superb grandchildren. Dennis has been an Arizona resident for the previous 32 years.