There are lots of advantages to hard money loans Texas traders make the most of. With quick approval, swift entry to funds, and lots of reimbursement choices, Texas hard money lenders are there to lend a serving to hand once you want them.

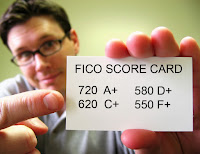

If you’re an actual property investor, there are numerous advantages to hard money loans Texas funding execs will vouch for. One primary profit is that Texas hard money loans are asset primarily based loans. What this implies for you is that your private funds do not matter, solely the benefit of your actual property funding concept. Many traders are self employed, which regularly signifies that their credit score rating is a bit lack luster. Private loans in addition to enterprise loans may over-extend your debt to revenue ratio. However, with hard money loans, Texas traders do not have to fret about this. Your hard money loan relies fully on the property you need to buy and your FICO rating doesn’t matter.

Along with being unbiased of your private funds, Texas hard money loans are quick. The appliance course of doesn’t take lengthy and you may often have your hard money funds in a pair days, and generally even much less. That is nice information for traders! This advantage of hard money loans, Texas traders depend on will help you buy houses at auctions or foreclosures. Quick entry to money funds could make your supply extra interesting and can provide you a greater likelihood of getting an awesome deal.

Suggestions and Tips for Getting Hard Money Loans Texas Investors Swear By

With the following pointers and slightly hard work, you may be getting hard money loans Texas traders trust very quickly!

Dennis Dahlberg Dealer/RI/CEO/MLO

Arizona Tel: (623) 582-4444

Texas Tel: (512) 516-1177

dennis@level4funding.com

www.Level4Funding.com

23335 N 18th Drive Suite 120 | Phoenix | AZ | 85027

111 Congress Ave |Austin | Texas | 78701

Dennis has been married to his great spouse for 38 years. They’ve 2 stunning daughters four superb grandchildren. Dennis has been an Arizona resident for the previous 32 years.