So you are exploring your financing options for your commercial business venture and maybe you haven’t even begun to see if you meet the necessary requirements for a bank loan since you’ve got your eye on a California hard money loan. Obviously, you need to choose the financing option that will work best for you, but it doesn’t hurt to know the difference between these types of loans.

So you are exploring your financing options for your commercial business venture and maybe you haven’t even begun to see if you meet the necessary requirements for a bank loan since you’ve got your eye on a California hard money loan. Obviously, you need to choose the financing option that will work best for you, but it doesn’t hurt to know the difference between these types of loans.

If you are in the California area or are looking at commercial real estate in California, you are probably hearing a lot about California hard money loans these days. Moreover, with “harder to find financing for” projects in your near business future California hard money loans can sound like just the thing you need. But, have you compared and contrasted the differences between these particular kinds of loans and more traditionally-funded loans i.e. good old bank loans?

Maybe you have done thorough research on bank loans and maybe you haven’t—no one is judging you. But, with state lending laws changing practically every couple of years, you definitely should stay up-to-date on what your actual lending options are. With that being said, let’s go over some of the current bank loan basics.

OF course that’s not to say there aren’t a few bank loan basics that are forever. For starters, as you may already know, bank loans are either funded via bank money or through bank-approved third party institutions. Bank loan approvals are heavily based on your credit scores and bank loans are now more difficult to secure due their specific guidelines, many of which have been put in place by state lending laws. Other major difference between hard money financing and bank loans include the how much the borrower’s income factors into being approved, interest rates, closing costs and the underwriting process —just to name a few.

Hard Money Expectations

So what can you expect with hard money financing? Well, obviously they are generally easier to get than bank loans as hard money is less regulated by state laws. Of course, hard money is often the financing of choice when you need your business venture funded sooner rather than later. Moreover, you can expect your income to not be as big a factor for approval as it is with a bank loan. However, what does matter more with lenders who offer hard money financing options is the value of your proposed collateral. In addition to the importance of collateral, interest rates tend to be much higher with hard money in order to compensate for the fact that they are sometimes approved almost instantly with loan terms ranging from weeks to several months. With bank loan terms you will typically see terms ranging from three to five years.

Closing costs and Underwriting

Lastly, closing cost for bank loans tend to range from two to five percent of the overall loan amount whereas hard money financing ranges from 3 to 10 points depending on loan amount. And in regards to closing cost, you will typically see banks using in-house software and lenders of hard money using third party underwriting service of their choosing.

![Level-4-Funding-Dennis-Dahlberg-Mort[1] Level-4-Funding-Dennis-Dahlberg-Mort[1]](https://lh3.googleusercontent.com/-aF-ke_K6CG4/V4Z0vHp_19I/AAAAAAAAJ30/J3B2tNpVP3o/Level-4-Funding-Dennis-Dahlberg-Mort.jpg?imgmax=800) Dennis Dahlberg Broker/RI/CEO/MLO

Dennis Dahlberg Broker/RI/CEO/MLO

Level 4 Funding LLC

Arizona Tel: (623) 582-4444

Texas Tel: (512) 516-1177

Dennis@level4funding.com

http://www.Level4Funding.com

NMLS 1057378 | AZMB 0923961 | MLO 1057378

22601 N 19th Ave Suite 112 | Phoenix | AZ | 85027

111 Congress Ave |Austin | Texas | 78701

About the author: Dennis has been working in the real estate industry in some capacity for the last 40 years. He purchased his first property when he was just 18 years old. He quickly learned about the amazing investment opportunities provided by trust deed investing and hard money loans. His desire to help others make money in real estate investing led him to specialize in alternative funding for real estate investors who may have trouble getting a traditional bank loan. Dennis is passionate about alternative funding sources and sharing his knowledge with others to help make their dreams come true.

Dennis has been married to his wonderful wife for 42 years. They have 2 beautiful daughters 5 amazing grandchildren. Dennis has been an Arizona resident for the past 40 years.

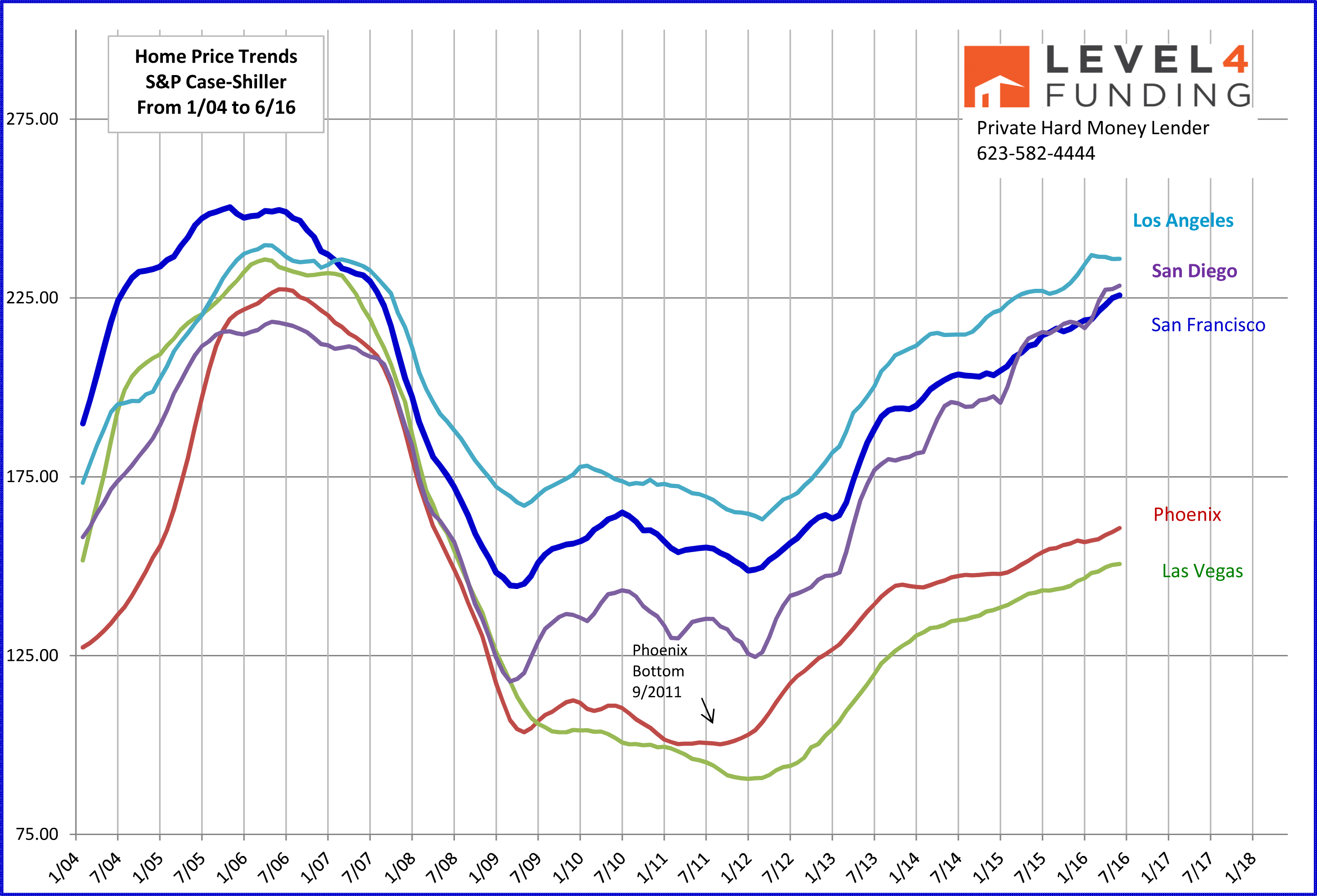

For Phoenix the bottom was officially September 2011.

For Phoenix the bottom was officially September 2011.