The place is the Actual Property Market Trending or Heading?

Okay.. had been again. Values are sky rocketing and costs are enhance at a pattern price that’s virtually straight up!

The (Im going to get technical right here with math) slope of the pattern graph for a few of the main metro space like Tampa, Los Angles, San Diego and Austin could be very giant quantity. This progress straight up! Prepare, for lotteries, traces and no properties. After all you could have been sleeping in case you are within the trade haven’t seen this but

The (Im going to get technical right here with math) slope of the pattern graph for a few of the main metro space like Tampa, Los Angles, San Diego and Austin could be very giant quantity. This progress straight up! Prepare, for lotteries, traces and no properties. After all you could have been sleeping in case you are within the trade haven’t seen this but

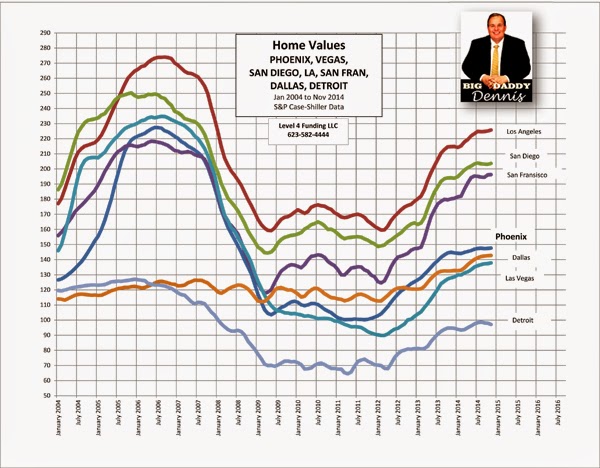

To look ahead, we should take a look at the place we had been previously. See the next graph. (For a excessive decision PDF model click here.)

It seems from the graph of Austin Home Values beneath, that the true property market within the Austin space is heading up. Is it time to purchase actual property once more? How lengthy will it take to return again to regular? Ought to I get out of the market and wait? These are hard inquiries to reply however listed below are Huge Daddy Dennis’s predictions and proposals:

ü Home values is not going to return to the pattern line for one more 1-2 years. Newest pattern exhibits Austin again to the highs beginning July 2015!

ü The upturn in values are because of LACK OF INVENTORY AND RECORD LOW INTEREST RATES.

ü Maintain your private home if doable. Do no matter it takes to maintain the present dwelling.

ü Do a loan modification? Its doable however there are only a few who’re profitable.

ü For those who ‘bail out’ and let the financial institution foreclose, you won’t be able to buy a house for 5-7 years, perhaps even by no means once more!

ü Inflation will come again and the worth of the greenback will drop dramatically. (This might change if the USA will lower spending and elevate taxes, lower medical/social safety, and enhance the tax price by 45%. I do not assume this can occur.)

ü The quantity of debt within the USA will proceed to develop. The quantity could be very horrifying to view it click here.

ü In 5-7 years, it should price $10 to purchase a loaf of bread. Gasoline will price $25/gallon. And the common starter dwelling worth shall be $600,000.

ü Get out of debt; eliminate the bank cards and pay them off. Buy solely when you have the money. Don’t get into any debt. (I sound like your mom right here, however she was right.)

ü Begin a facet enterprise. It’s too tough to elucidate right here why, however one of the best cause is the potential tax benefit and the doable earnings. Your personal facet enterprise is the LAST space the federal government has but to assault. Make it easy and get going. An additional $400 per 30 days actually helps.

ü In case you are in a position, buy high quality single household properties in an excellent space and switch them into rental items. (Your facet enterprise?)

I’ve talked to lots of people who really feel that they’ll ‘let their dwelling go and hire for awhile’. Rental charges are decrease than their mortgage charges. Sure, they’re! ‘We will save lots of money by renting vs. paying the mortgage, and in 2 years we are able to buy once more and have an excellent down fee.’ Properly, it’s really going to be 5-7 years earlier than your credit score report appears good to buy a house once more. And might you actually save the money? Most individuals will spend the money on toys. If hyper inflation hits, like some economist predict, then you definitely’ll be priced out of the market. Do you need to take the prospect? Maintain your private home, do a HARP 2 loan modification, and cling on – the following 5-7 years are going to be satisfying.

With low stock and too many consumers, the Austin Actual Property Market is on the verge of a brand new growth in actual property values.

With low stock and too many consumers the Austin Actual Property Market is on the verge of a brand new growth in actual property values.

‘This growth goes to be totally different,’ in line with Dennis Dahlberg, Degree four Funding Hard Money Lender . ‘The final growth was fueled on greed of the patron; this time it’ll be a provide drawback. Over the previous 6 years there was little development or motion of dust, leaving the Austin housing market ravenous for brand new properties. Moreover, dwelling values are elevating dramatically, and as soon as the present dwelling house owners get above water (have fairness) they’ll need to transfer up. We’ll have a trifecta or the proper storm-no properties, pent-up demand, and document low rates of interest. And in case you throw somewhat inflation on high of the combination — be careful! Bam! its going to be a wild journey — a wild west journey!

Dennis Dahlberg

Dealer/RI/CEO/MLO

Tel: (512)-516-1177 Austin Texas | Fax: (888) 279-6917

NMLS 1057378 | AZMB 0923961 | MLO 1057378

111 Congress Ave Suite 400

Austin TX 78701

Dealer/RI/CEO/MLO

Tel: (512)-516-1177 Austin Texas | Fax: (888) 279-6917

NMLS 1057378 | AZMB 0923961 | MLO 1057378

111 Congress Ave Suite 400

Austin TX 78701